Pondering the Drop in Ringgit Value

- mansorhi

- Sep 27, 2022

- 7 min read

There has been recently growing uneasiness and concern over the sliding value of the Ringgit against the US dollar. At the beginning of the year (Jan 3, 2022), the rate was RM4.175 per USD. At the close of September 21, the Ringgit was at 4.556 per USD, a drop of roughly 9.1%. Some have come forward to allay this concern by noting that we should not look at the Ringgit-USD rate alone in making assessment of Ringgit value. Indeed, the Ringgit has appreciated against other currencies in recent days such as Japanese Yen and Thai Baht. However, looking at the trade-weighted exchange rate or the real effective exchange rate, which measures the value of the Ringgit against a basket of trading partners’ currencies, has also demonstrated a sliding value in tandem with the Ringgit-USD rate.

In recent months, central banks have hiked interest rates in sync [1]. The Federal Reserve Bank has aggressively raised the federal fund rate by 50 basis points on May 4, 75 basis points on June 15, 75 basis points on July 27 and most recently 75 basis points on September 21. The Federal Reserve chair Jerome Powell has stated loud and clear that the moves are to crush inflation and bring it to its 2% objective. Other countries have also raised policy rates not only to tame inflation but also the stem the declining values of their currencies. Malaysia is no exception to this worldwide monetary tightening. The central bank of Malaysia, i.e. Bank Negara Malaysia, has hiked the overnight policy rate three time in succession in May, July and September, each by 25 basis points. Many expect that the Monetary Policy Committee (PMC) of BNM will raise the policy rate further in the future. While the monetary policy tightening is justified as monetary policy normalization, it also has attracted discussion whether it is able to tame inflation and to strengthen the Ringgit or at least stem further sliding of the Ringgit value. Given the concern that we have on sliding exchange rate value, a pertinent question is: Is monetary policy tightening effective in stabilizing the Ringgit?

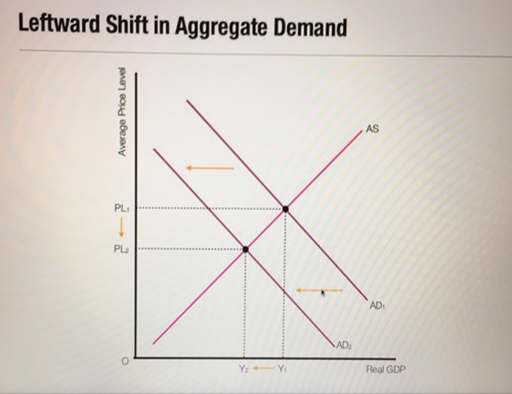

Theoretically, the answer to the question is a priori uncertain. According to the conventional wisdom (the traditional view), high interest rates can stabilize exchange rates by making domestic assets more attractive, reducing capital flights and discouraging speculation. By contrast, the alternative view (the revisionist view) posits that a rise in interest rates may lead to further decline in currency values due to increasing default probabilities. In addition, the increase in the interest rate may not be sustainable due to the macroeconomic costs associated with the need to sustain high interest rates, rendering monetary tightening to lack credibility [2].

We look at Malaysia’s recent experiences by graphing the movements in the Ringgit-USD rate after the hikes of the US federal fund rate and the BNM overnight policy rate in three periods: (i) May 4 – June 14, (ii) June 15 – July 26, and (iii) July 27 – September 20. In each period, we normalize the rate to 100 for the first date of each period, i.e. May 4, June 15 and July 27, for ease of comparison. Recall that these three dates are dates that the Federal Reserve Bank increased the federal fund rate. If the rate is above 100, it means that the USD appreciates against the Ringgit (or the Ringgit depreciates against the USD) and vice versa. In each graph, we also note the dates at which the BNM raised the policy rate. In all three periods, as depicted in the graphs below, the USD appreciated against the Ringgit (or Ringgit depreciated) after the fed rate increase in all periods (but note that in the second period, the USD value dropped first before it went up). This has been widely noted in the discussion that the USD has been strengthening as a result of the FED’s aggressive monetary stances. From the graphs, it is also obvious that the policy rate hikes by the BNM have not been followed by appreciating or at least stabilizing Ringgit. In all three cases, the Ringgit continued to depreciate against the USD.

Malaysia’s exchange rate experiences after monetary tightening tend to conform with the revisionist view on the relation between monetary policy and exchange rate. However, it would be too shaky to take the graphs above as providing causal description of monetary policy and exchange rate movements. Remember the “Post hoc ergo propter hoc” fallacy. At the same time, the proponents of the traditional view may argue that the decline in the Ringgit can be worse if the BNM has not hiked the interest rate. While the relation between interest rate and exchange rate continues to be contentious, there may be a need to look beyond the interest rate.

Some have pointed out trivially but correctly that there may be other factors that shape the movements in the Ringgit. It is trivial because no one would disagree that exchange rate movements are governed by myriads of factors. It is correct because theories have suggested numerous determinants of exchange rates. Hence, the next pertinent question would be, for the case of Malaysia, what are the most likely factor(s)? The answer to this question would not be easy and whatever the answer is would surely solicit debates among us.

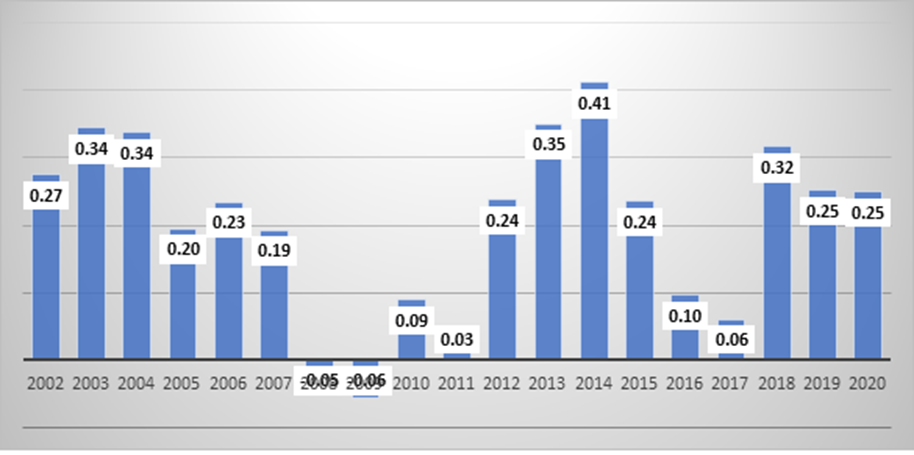

Indeed, when we look at Malaysia’s current economic outlook, we will be drawn into further bewilderment as to why the Ringgit has not strengthened or stabilized in value. The country’s Q2 growth is above expectation, recording a year-to-year Q2 growth of 8.9%. The Finance Minister has been highly optimistic regarding future growth outlook, where the growth for 2022 is likely to surpass official projections of 5.3-6.3%. The retail sales and exports have shown strong momentum. The retail sales are at a record level in Q2, up by 62%. Meanwhile, Malaysia’s exports are up 38% on year in July 2022 and 48.2% in August 2022, making it 13th successive months of double-digit growth. The downtrend in Malaysia's FDI since 2016 has also been reversed. Malaysia recorded the inflows of RM48.1 billion in 2021, the highest since 2016. Then, with export diversification, Malaysia is unlikely to go to recession. These numbers together with inflation figures, which are still low relatively to inflation rates in the US and in other trading partners, do not seem to justify the current slide in the Ringgit.

Perhaps, we need to look deeper. Examining the RM-USD rate or the Ringgit real effective exchange rate, one would notice that the downtrend in the Ringgit value has started long before. In fact, the current drop in the Ringgit is marginal in comparison to the drastic drop during late 2015 and early 2016. During the period, the Ringgit crossed 4.00 for the first time since the Ringgit de-pegging in 2005 and stayed there since (except for certain short periods). I believe that the problem we face is more entrenched than we may have thought and that may account for the fact that the Ringgit is weak despite positive and strong outlook. In my opinion, the problem can be summed up in one word: “CREDIBILITY”. Our credibility and credible commitments to certain policy actions may have eroded over the years. While investors may be able to shed light on the issue of credibility and confidence, we may get some hints if we place ourselves in their shoes.

The unfolding of 1MDB scandal saw the Malaysian exchange rate against the US to cross 4.00, as noted above. At the beginning of 2015, the Ringgit stood at 3.498 per USD. In January 2015, 1MDB missed a loan payment of about $550 million. The special taskforce to investigate 1MDB was set up in March 2015. The 1MDB saga became a major international headline with the Wall Street Journal reporting the embezzlement of fund of nearly $700 million. The issue was far from being addressed as the Prime Minister sacked the attorney general who led the investigation and removed his critics including the Deputy Prime Ministry. While being dubbed as the heist of the century, the new attorney general cleared the Prime Minister of any wrongdoing. Two newspapers under the Edge Media group were suspended their printing permits for three months due to their reporting of 1MDB. Internationally, the US Department of Justice filed a civil suit in July 2016 to seize the stolen 1MDB assets. While the siphoned 1MDB fund was orchestrated as being a donation, it was not received as such by many where dissenting voices became louder and stronger. If we go back to 2015, we may note intense discussion on the issue and many analysts have warned that the 1MDB case would dent investors’ confidence. Would you be less confident of Malaysia If you were investors? I would. On August 13, 2015, the ringgit closed at 4.025 per US dollar.

Subsequently, Malaysian politics became very fragmented and polarized, perhaps at the level not seen before in its post-independence era. The 61-year reign of Barisan Nasional (National Coalition) came to an end in the 14th general election. The Pakatan Harapan (Alliance of Hope) came into power by winning 56% of the seats contested (i.e. 125 out of 222 seats). The new government proved to be fragile, where it collapsed after only 22 months in power. The game of number and political fighting has shaped Malaysia’s political scene with the ensuing falls of several state governments under Pakatan Harapan. Barisan Nasional managed to control the government back just after 17 months of the newly formed government with Ismail Sabri sworn in as the Prime Minister in August 2021. Political instability is the order of the day. With the focus on politics, less has been on building the nation socially and economically. The pandemic has further exacerbated the situation. Again, I would say with certain confidence that investors’ confidence and Malaysia’s credibility has been further eroded.

Finally, even we accept that the gradual policy rate hikes are able to at least prevent drastic drop in the Ringgit value, we need to ask whether the government can “credibly” commit to this policy stance to continue increasing even gradually the policy rate following the future bigger rise of the federal fund rate. Global recession is looming. Government debt is at high end. Households are highly leveraged. In other words, the social and economic costs associated with following the federal fund rate can be prohibitive. The lack of credible commitment is hence very apparent and an inevitable conclusion.

To end this writing, I should note that I am in no ways discredit other factors that have been cited as the causes of the declining Ringgit, in particular the aggressive stance of the US in fighting inflation. The movements of exchange rate are driven by many confounding factors in a complex way. But, I do believe that the “credibility” issue stands out as one major factor that needs to be addressed immediately and responsibly.

[2] Ibrahim, Mansor H. (2009). Exchange rate and interest rate in Thailand: A look at traditional and revisionist views. Journal of Applied Research in Finance 1(2), 135-140.

Comments