Don't Mess with Monetary Policy

- mansorhi

- Jul 15, 2022

- 7 min read

The decision by Monetary Policy Committee (MPC) on July 6 to increase the overnight policy rate (OPR) by 25 basis points, which is the second this year after the increase in the previous MPC meeting in May, has drawn much discussion. I have participated in the discussion on the role of monetary policy tightening in curbing inflationary pressure. I find the discussion to be enriching.

Most recently, the Director of Economy, Prime Minister’s Office suggested that the BNM 2009 Act be reassessed and amended such that the monetary policy implementation does not involve solely the MPC (or the BNM). He also stated that the BNM should explain in details including to the Parliament any policy implemented. The Director of Economy may have his points, given that the implication of interest rate hike is far-reaching affecting all individuals and segments of society and given the need for policy coordination in this tough time.

His suggestions have received various responses, even within the government. The Finance Minister, for instance, stresses that “it would be “fatal” for the central bank to rely on government decision” and that “government intervention in monetary policy decisions would affect financial market integrity” (1). Others have emphasized the importance of central bank independence for the BNM to achieve price stability together with sustainable growth and financial stability.

The issue of central bank independence (CBI) is not new. Indeed, within the scholarly circle, it was intensely discussed in the 1980s, driven by the theoretical work by Finn Kydland and Edward Prescott (1977) on time inconsistency (2). “Time Inconsistency” refers to the idea that an optimal policy at time 0, once set, is not optimal in future times and hence is not credible. To be more specific, the monetary authority targets and sets a certain inflation rate for its price stability objective. However, once the target is set, there would be temptation to inflate to produce short-term increase in output and employment. Knowing this, economic agents would not take the inflation target by the monetary authority as credible and consequently, with the expectation of government’s inflating the economy, will expect higher inflation to begin with. The monetary authority then has to conform to this higher expected inflation to avoid output loss. The result is inflationary bias. Cukierman (1996) and Barro and Gordon (1983) explain more lucidly this inflationary bias using game-theoretic models of policymaking (3)(4). From these, we may sum up the key theoretical prediction: TIME-INCONSISTENT POLICIES ARE NOT CREDIBLE.

To overcome the time-inconsistency problem, Kenneth Rogoff (2005) argues that the conduct of monetary policy should be entrusted to independent central banks (5). Arguably, policy commitments of the central banks would be credible and resolve the problem of time inconsistency if they are insulated from political pressures, where politicians in power may rationally have objectives different from price stability. Moreover, by being independent, it would be easier for the central banks to commit to certain monetary policy rules. Involving the government with monetary policy would open door to too much “discretion”. It would also make monetary policy to be dominated by fiscal policy, the so-called “fiscal dominance” thesis, where monetary policy is re-oriented towards supporting fiscal policy (or more exactly, monetization of the deficits).

These ideas have led to a policy consensus that CBI is key to inflationary stability and, in practices, have resulted in monetary policy reforms in many countries. Between 1985 and 2012, there were 266 central banking reforms, where 236 of them took place in developing countries and roughly 77% of them involved strengthening central bank independence (6). The progress in the monetary policy framework is generally characterized by central banks’ being given more independence. In other words, taking away the autonomy of central banks would mean regression.

Being a student of monetary economics, I have been drawn into these ideas and have followed the literature on the issue since late 1980s. The preponderance of empirical evidence substantiates the positive relation between central bank independence and inflation stability or economic performance for developed countries, developing countries and countries in various regions and continents (6). In my teaching of Monetary Economics at the post-graduate level, one of many questions that I normally raise in the first class: Is monetary policy stabilizing or destabilizing? Throughout the course, we go through alternative theories linking monetary policy to economic outcomes. These cover the classical theory, the Keynesian theory, the Keynesian synthesis, the Friedman’s monetarism, the rational expectation theory, the time-inconsistency problem, and the game-theoretic approach to monetary policy. At the end of course, we generally conclude that policy “credibility” is of paramount importance in monetary policy and this credibility can be built and enhanced when the central banks are independent. And, our review of empirical evidence provides a strong support for this conclusion.

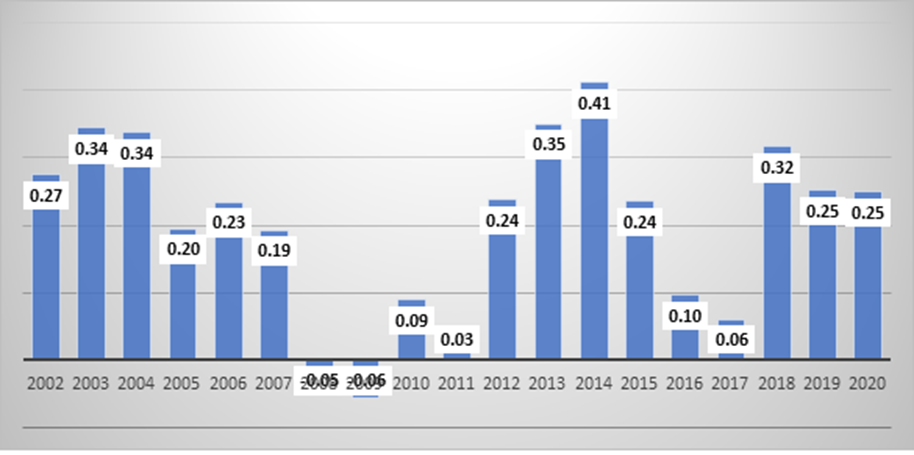

On the basis of these, despite potential benefits of policy coordination, I view that it is unwise to involve the government in monetary policy. There are three facts that I would like to put forward. First, we have to admit the fact that our (government) institutions are not strong enough to overcome the time-inconsistency problem, in particular in terms of corruption control. Figure 1 panel (a) below provides the Control of Corruption Index for Malaysia from 2002 to 2020. The data are from the World Governance Indicators Database provided by the World Bank. The index is normalized to take the values from -2.5 to 2.5 with the higher values indicating better corruption control. Overall, the corruption control is still at the low levels as compared to the maximum score of 2.5, while I should note that Malaysia has not been in the bottom half (to be more exact, Malaysia is at roughly 62nd percentile during the period). As may be observed from the figure, the index deteriorated (less corruption control or more corruption) from 2002 to 2009. Then, we observe improvement in the corruption control, where the index reached its peak in 2014 at above 0.4. After 2014, the index dropped again (one may guess what the likely reason is in 2015-2017). Despite the improvement after 2017, there is lingering concern that it might go down again in recent years. This pattern is reaffirmed by the Corruption Perception Index by Transparency International for the last 10 years ending 2021. Indeed, in 2021, the index dropped further. [Note: Corruption Perception Index ranges from 0 to 100 with higher values indicating lower corruption.]

Figure 1: Corruption in Malaysia

(a) Corruption Control Index (World Governance Indicators)

(b) Corruption Perception Index (Transparency International)

Based on the Corruption Perception Index, Malaysia dropped 5 spots from 57th in 2020 to 62nd in 2021. Responding to this, the Chief Secretary to the Government Tan Sri Mohd Zuki stated at the launch of the 2022 Integrity, Governance and Anti-Corruption Awards (AIGA 2022), “Even though it is merely a perception, the reality is that it is an important signal to all of us to eradicate corruption by cultivating high integrity among agencies and individuals whether in the public service or the private sector” (7). Last year, the former Auditor General predicted that up to 30% of the allocation to the public projects was lost due to mismanagement and corruption and the chief of Malaysia Anti-Corruption commission added that corruption in government procurement is seen to be increasingly critical and is ranked at the top in financial losses (8). These perhaps explain why the Finance Minister stated “it would be fatal” to depend on government decision in the implementation of monetary policy as noted above. With corruption, policy announcements would be hardly credible.

Second, even some may brush aside the issue of corruption, we still need to acknowledge that Malaysia’s public debt is high. The government has increased the statutory debt limit to 65% of GDP to cater for the financing needs as a result of the pandemic. According to the Deputy Finance Minister, the government’s debt as at the end of December 2021 was RM979.8 billion. This amounts to 63.4% of GDP (9). In the model by Barro and Gordon (1983), the extent of inflationary bias depends on various factors, one of which is the level of government debt. The prediction of the model is the higher the level the public debt, the more temptation the government would have in inflating the economy. Take note that this is perfectly rational. But, it results in higher inflation than it should be. Accordingly, monetary policy commitments would be even less credible in this case.

And finally, monetary policy and its design and implementation are highly technical. I have to admit that, even I have taught monetary economics for so many years, I still do not have clear idea on so many aspects of monetary policy. I always say to my students, I love monetary economics because I do not understand so many things about monetary economics. For me, we need to acknowledge that we are ignorant on so many things and hence we should not interfere in things we have no knowledge of. Even Milton Friedman builds his recommendation of monetary policy rule, i.e. k% growth of monetary aggregates, on policymakers’ being “ignorant”. I would not take so far like Friedman to think that all policymakers are ignorant about monetary policy and how it works. But taking note from his view, I would say leave monetary policy to those professionals who know more than most of us and more than most in the parliament.

When I read the suggestion to involve other than MPC or BNM in monetary policy, I immediately recall Friedman’s views and the ignorance of us in understanding the economy. It also reminds me a slogan that was used by Melaka State Government in its cleanliness campaign: don’t mess with Malacca. In the sprit of Friedman and the “cleanliness” campaign, my end words: “Do not mess with monetary policy”.

REFERENCES (1) (https://www.nst.com.my/business/2022/07/811721/government-bank-negara-not-operating-silo).

(2) Kydland, F.E. and Prescott, E.C. (1977). Rules rather than discretion: the inconsistency for optimal plans. Journal of Political Economy 85, 473-491.

(3) Cukierman, A. (1996)

(4) Barro, R.J. and Gordon, D. (1983). The positive theory of monetary policy in a natural rate model. Journal of Monetary Economics 12, 101-121.

(5) Rogoff, K.S. (1985), The optimal degree of commitment to an intermediate monetary target. Quarterly Journal of Economics 100, 1169-1189.

(6) Garriga, A. C. and Rodriguez, C.M. (2020). More effective than we thought: central bank independence and inflation in developing countries. Economic Modelling 85, 87-105.

Comments