MALAYSIA’S OPR HIKES AND INFLATION

- mansorhi

- Jul 8, 2022

- 5 min read

Bank Negara Malaysia (Malaysia’s Central Bank) has increased the policy rate twice in succession this year by 25 basis points in May 2022 and another 25 basis points in July 2022, which brings the policy rate to currently 2.25% from 1.75% prior to the hikes. Many expect that the rate will be increased in future Monetary Policy Committee meetings in a gradual manner towards 3%.

In its two press statements (in May and in July), BNM mentions that the unprecedented conditions that prevailed during the Pandemic and necessitated the low interest rate environment have abated. Thus, the hikes are essentially a monetary policy normalization while BNM policy stance remains accommodative to support growth. The statements also provide overview of economic conditions and outlook of and risks to growth and inflation.

While BNM does not state explicitly the macro objectives of the hikes, some analysts offer views that the increases are to contain inflationary pressure that has been built up due to disruptions in supply chains, escalation in oil and commodity prices and others. The conventional wisdom says that the increase in the policy rate will contain inflation.

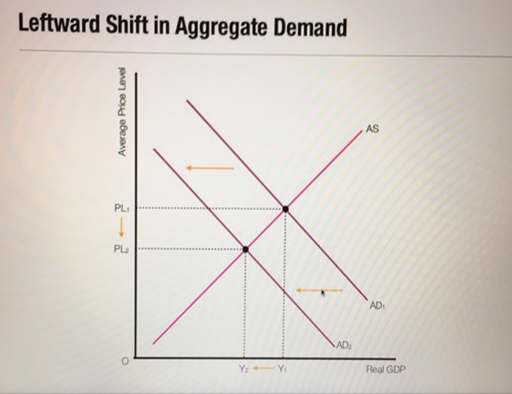

The arguments underlying this conventional wisdom, as some have offered, are straightforward. The interest rate increases mean higher cost of borrowing. This would discourage households’ consumption of durable goods and firms’ investment and, as shown in the standard AD-AS above, lead to a leftward shift in the aggregate demand. The economy settles at a new equilibrium point with lower price level and lower output. It has been noted that the aggregate demand starts to pick up since the move into endemicity, driven by consumption and exports. Thus, the overriding concern is inflation. On this, to many analysts, the move is justifiable.

I have no qualm with the above analysis. The textbook AD-AS framework enables us to understand how an economy works and how it responds to changes such as the changes in monetary policy stances. However, I also believe that we should be cognizant of the context. At the same time, we should not be oblivious of the assumptions underlying this simple and static AD-AS analysis.

Let put more meats into the above analysis.

First, in terms of the context, where was the Malaysian economy before the rate hikes? The initial equilibrium? It is not hard to argue that real GDP was below potential GDP. Due to the pandemic, the real GDP contracted in 2020. Although it went up in 2021, it did not reach the level recorded in 2019. During the same period, despite the covid-19 pandemic, total labor force increased and capital formation recorded positive figures. This means that the actual output has been down while the potential output up. Then, it is well acknowledged that we have faced higher prices or inflationary pressure. Many would agree that this inflationary pressure has been driven more by supply-side (costs) factors than by forces of demand. If we accept this context as well as the standard AD-AS analysis above, would we be willing to push down real GDP further away from the potential output? What are the output costs of the rate hikes? Or, while we try to contain inflation, are we hoping for exports to pick up further to compensate for the drop in domestic demand? Will exports pick up when the global economy is expecting recession? By bringing the context to the AD-AS graph, there seems to be more questions to be answered.

Second, the AS-AD analysis above has BIG assumptions. The AD is built on the assumptions that the goods and money markets function well. As macroeconomists know, AD represents the equilibrium in both goods and money markets. The upward-sloping AS depicted above is interesting. It is built on either (i) labor market frictions where wages are sticky and hence potential labor market dis-equilibrium, or (i) imperfect information. I can make the argument here that even the goods market is not perfect. We may have heard one “stylized fact” in economics that: “prices are up like a rocket and down like a feather.” Yes, prices tend to be stickier downward. This means that the “ratchet effect” is potential. In other words, when the AD shifts leftward, there will be reduction in output with no discernible drop in the aggregate price level.

Third, let pour some more details into the AD-AS model by incorporating uncertainty and information frictions, which I believe is not unrealistic. The question is: is monetary policy effective in influencing the aggregate demand which in our case, contracting AD by increasing the rate? It is very hard to tell, due to many different forces counteracting each other. It is potentially likely that the increase in the interest rate may lead to expectation of further increase. Indeed, many analysts and news have fueled this expectation by projecting further increases in the policy rate this year and next year. If this is the case, despite the recent hikes in OPR, the expectation of further increase may stimulate current spending.

In the context of banks, the increase in the interest rate may be translated to higher credit risk. Indeed, various studies have provided empirical supports for a direct relation between interest rate and risk. If this is the case, although the lending rate is higher, the expected return from financing may not necessarily be higher. The effect of this is perverse. On one hand, with higher risk, banks may curtail financing. On the other hand, given that the monetary policy remains accommodative (where interest rate is still low), banks may take more risk by extending more credit. We may further argue that the tightening of monetary policy can set in motion the financial accelerator mechanism. The consequence is the output drop can be amplified and more than we predict.

Note that I am not scrambling all over of the effects of the interest rate increase here. Once uncertainty and imperfections are considered, these are possibilities (whether the likelihood of each possibility is high or low is another issue) that we need to acknowledge. The impacts of monetary policy can be murkier than what we might think from the simple AD-AS lens.

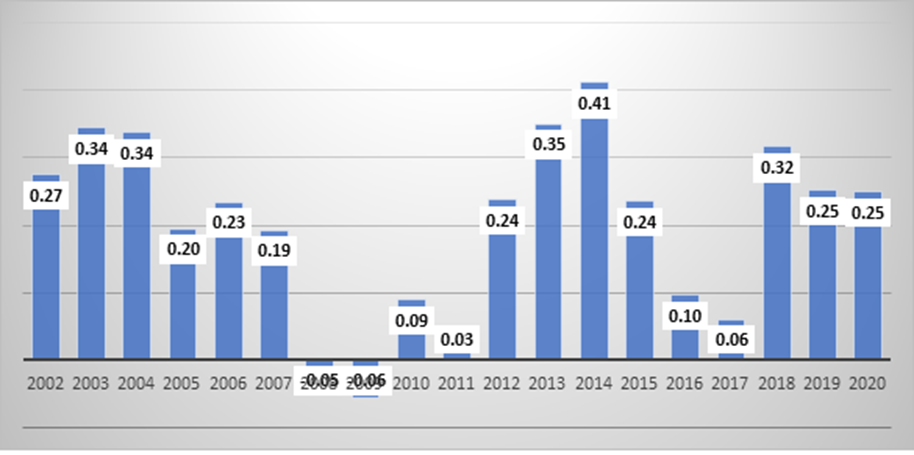

And finally, let's accept the conventional wisdom that following the contraction in bank loans and consequent reduction in aggregate demand, inflationary pressure can be curtailed. We still need to ask: who would be affected more by the interest rate increase? Empirical evidence abounds that monetary policy entails distributive consequences, where the household sector will be affected more than the business firms, the poor affected more than the rich, and small firms affected more than big firms. My own works on the distributive consequences of monetary policy provide quite concrete supportive evidence for both Malaysia and Middle-Income countries.

Before my views above are construed as against the interest rate hikes, let me clarify that I am not. What I am trying to bring to the attention is that there is no simple link between monetary policy and inflation. To me, and also stated by BNM, the increase in the interest rate is essentially monetary policy normalization. Malaysia, and many other countries, have been under a low interest rate environment for too long resulting in the build-up of risk raking and debts with potential consequences on financial instability and systemic risk. As the economy is recovering from the pandemic, it is reasonable to normalize the monetary policy. A way forward, as this normalization may have negative effects as noted above, we need to design a framework to manage monetary policy normalization. Economists at the Federal Reserve Bank of New York have forwarded such a framework for the US case. We need to have a framework to fit our case. I have no suggestion at the moment. This requires another discussion.

Comments